|

This option contains a number of additional utilities to help the tax practitioner, like statutory forms, calculators for tax, tds and capital gains.

|

More than 300 forms spread across assessment years are available at a mouse click. Moreover, every form has got expert guidance built-in to ensure mistakes are minimised.

The forms are in state-of-the-art Adobe’s PDF format. In order to use this feature you should have installed the freely distributed Adobe™ Acrobat Reader™ 9.0 or higher. In case you do not have this, you may install it from TLOL Suite™ 3.0’s DVD from the ACROREAD directory.

|

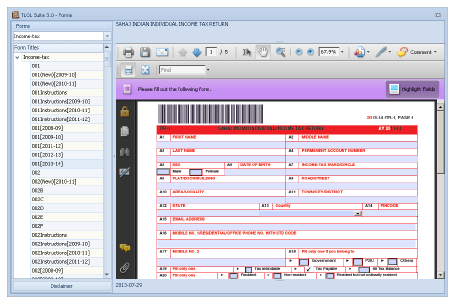

⇖ Click on ☰ Utils → Income Tax Forms to open the “TLOL Suite™ 3.0– Forms” interface.

Choose the Act name from the pull-down menu cum Easy-select field.

The selected Act will be highlighted.

⇖ Click on the > against the selected Act to view the list of form numbers.

⇖ Click on the required form number to view the form.

Save option is available only if you own a license for Adobe Acrobat. If you require to save the form choose this ![]() disk icon seen on top of the form window; in the dialogue box that comes up, enter the file name to save in. To restore a saved form choose ☰ File → Open and select the file to restore.

disk icon seen on top of the form window; in the dialogue box that comes up, enter the file name to save in. To restore a saved form choose ☰ File → Open and select the file to restore.

It is recommended that, when filling forms your entry does not exceed the width and height of the input box provided on screen.

|

Income Tax Calculator is used to compute the income tax to be paid by a assessee.

Computation will be based on the type of assessee and assessment year followed by the inputs from you. The following are common inputs required 2

Type of Assessee

Assessment Year

Taxable Total Income

|

⇖ Click on ☰ Utils → Tax Calculator to open “TLOL Suite™ 3.0– Income-tax Calculator” interface.

Depending on the type of assessee you will have to enter various figures mentioned in the Income-tax calculator screen and ensure your input is complete.

⇖ Click Calculate to compute the amount of Income-tax to be paid.

⇖ Click Reset to clear the fields and enter data afresh.

⇖ Click Close to close the form.

Select “Domestic Company” from the pull-down list within the field displayed against Type of Assessee.

Select “2010-11” from the pull-down list within the field displayed against Assessment Year.

Enter “5000000” in the field displayed against Taxable Total Income.

Enter “22456“in the field against Book Profit.

⇖ Click Calculate to compute the amount of Income-tax to be paid by the company.

|

The TDS calculator computes the income-tax to be deducted at source.

Computation is based on the nature of payment and assessment year followed by other inputs from you. The following are common inputs required3.

Nature of Payment

Assessment Year

Total Amount Payable

|

⇖ Click ☰ Utils → TDS Calculator to open “TLOL Suite™ 3.0–Tax Deduction at Source Calculator” interface.

Depending on the nature of payment you will have to enter various figures mentioned in the TDS calculator screen and ensure your input is complete.

⇖ Click Calculate to compute the amount of Income-tax deduction at source.

⇖ Click Reset to clear the fields and enter data afresh.

⇖ Click Close to close the form.

Select “193-Interest on salaries” from the pull-down list within the field displayed against Nature Of Payment.

Select “2009–10” from the pull-down list within the field displayed against Assessment Year.

Select “Interest on 8% savings (taxable) bonds” from the pull-down list within the field displayed against type Of securities.

Select “Domestic company where payment > 1 crore” from the pull-down list within the field displayed against type of recipient.

Enter “2000000” in the field displayed against Total Amount Payable.

⇖ Click Calculate to compute the amount to be deducted.

|

The Capital Gains Calculator computes the short-term/ long-term capital gain tax on applicable transactions.

|

Short-term/ long-term capital gains can be computed based on the inputs from you4. The following are common inputs required.

Date Of Purchase

Date Of Sale

⇖ Check the box displayed against In case of shares, if required.

Type of Assessee

Short-term or long-term capital gain calculation will be automatically selected depending on the number of months between purchase and sale.

⇖ Click ☰ Utils → Capital Gain Calculator to open “TLOL Suite™ 3.0–Capital Gains Calculator” interface.

⇖ Click Calculate to compute the Capital gains.

⇖ Click Reset to clear the fields and enter data afresh.

⇖ Click Close to close the form.

Select “Date of Purchase” as “08/03/2012”.

Select “Date Of Sale” as “06/03/2013”.

The number of months and the “Type of Capital Gain” for the assessment year and the Financial Year will be displayed.

Select “Individual” from the pull-down list within the field displayed against Type of Assessee.

The fields for “SHORT TERM” will appear.

⇖ Click on the ⌼ radio button to the left of the field displaying Lump Sump Sale.

Enter “10000” in the field displayed against Full value of consideration.

Enter “1000” in the field displayed against Net worth of undertaking or division.

Enter “1000” in the field against Cost of the agriculture land purchased.

Enter “9000” in the field against Cost of the land or building purchased.

⇖ Click Calculate to compute the Net short-term capital gain.

1. The content available under this section will depend on the modules subscribed to.

2. Fields will be enabled based on selection made.

3. Fields will be enabled based on selection made.

4. Fields corresponding to your selection will be enabled automatically.